Summary:

- Coinbase introduced wallet infrastructure built specifically for AI agents, allowing them to spend, earn and trade crypto.

- The system lets users set controls and permissions so agents can manage liquidity and execute trades autonomously.

- The launch includes AgentKit, a developer toolkit designed to connect AI models with blockchain functionality.

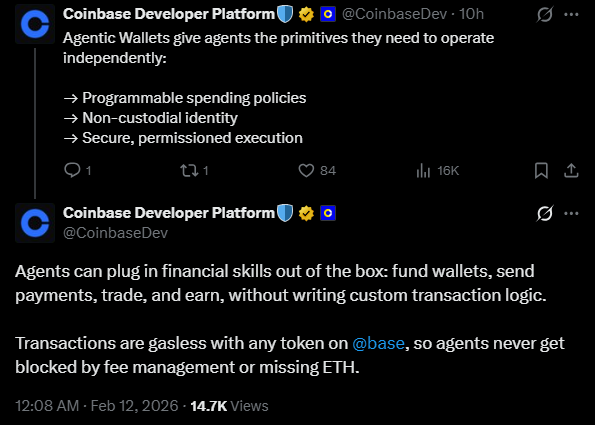

- Features include programmable spending policies, non-custodial identity and permissioned execution.

- Transactions run on Coinbase's x402 payments protocol and can be gasless on Base, reducing friction for automated agents.

Coinbase has taken a direct step into the intersection of artificial intelligence and digital assets by launching crypto wallet infrastructure designed specifically for AI agents. These are software programs capable of operating independently analyzing information, making decisions and now, executing financial transactions without constant human input. In a post published Wednesday, Coinbase developers Erik Reppel and Josh Nickerson introduced what the company calls Agentic Wallets, part of a broader framework named AgentKit. The goal is to move AI systems beyond simple tasks like answering questions or summarizing documents. Instead, these agents can now interact with blockchain networks in a way that mirrors how a person might use a crypto wallet.

This changes what an AI system can do in economic terms. Users can define permissions and guardrails that allow an agent to manage liquidity positions, send payments or execute trades at any time of day. The agent acts within those limits, meaning the human sets the strategy and boundaries, while the software handles the operational side. Coinbase described the foundation of this system in its developer things and described the primitives they need to operate independently. Also put on X,

Also the emphasis on programmable spending policies is important. Instead of handing full control to an automated system, users define how funds can be used. That could mean setting limits, restricting certain actions or requiring specific conditions before a trade happens. The agent becomes an operator, not an unchecked decision-maker.

Inside AgentKit and the developer stack

Alongside the wallet infrastructure, Coinbase rolled out AgentKit, a toolkit aimed at developers building AI-driven applications that need to interact with blockchains. The design focuses on flexibility and ease of integration, so teams don't have to build complex crypto infrastructure from scratch. In its launch materials, Coinbase outlined the technical direction of AgentKit:

Put simply, AgentKit acts as a bridge between AI models and crypto and a developer can plug in an AI model - whether from OpenAI, Anthropic or another provider - and give it the ability to read blockchain data, manage assets and interact with smart contracts. The heavy lifting around wallet security, transaction signing and network communication is handled by Coinbase's infrastructure.

Transactions for these agents run through Coinbase's x402, described as a payments protocol purpose-built for autonomous AI use cases. According to the company, the system has already seen tens of millions of transactions, suggesting that machine-to-machine payments making transactions gasless on Base, Coinbase also removes one of the practical pain points for automation that managing native tokens just to pay network fees.

Where AI and crypto meet in practice

Coinbase framed the broader vision under what it calls the future of AI and crypto. Coinbase described scenarios where agents could:

These examples show a shift from AI as a passive assistant to AI as an economic participant. An agent could watch market data, rebalance a portfolio, claim staking rewards or manage decentralized finance positions around the clock. For businesses, that could mean automated treasury management. For developers, it opens the door to applications where software systems transact directly with each other. There are still open questions, of course that Autonomy raises concerns around oversight, accountability and risk. A misconfigured policy or flawed model could lead to unwanted trades or losses. That is where Coinbase's emphasis on permissioned execution and policy controls comes in. The design assumes that humans remain in charge of the framework, while the agent handles execution.

The launch of Agentic Wallets signals that crypto infrastructure is being shaped for software actors as well. As AI systems become more capable, giving them structured, rule-based access to financial tools could change how digital services operate behind the scenes.

READ MORE: DeFi’s Privacy Crisis: How COTI Could Be the Answer to a $1 Billion Problem