Summary:

- US President Donald Trump denied knowledge of a $500 million investment by Abu Dhabi royal Sheikh Tahnoon bin Zayed in the World Liberty Financial (WLFI) crypto platform.

- Reports suggest the deal, finalized four days before Trump's inauguration, gave the UAE entity a 49% stake in WLFI.

- First installment of $250 million reportedly sent, with $187 million directed to Trump-family entities and $31 million to WLFI founders.

- Trump distances himself from multimillion-dollar WLFI investment

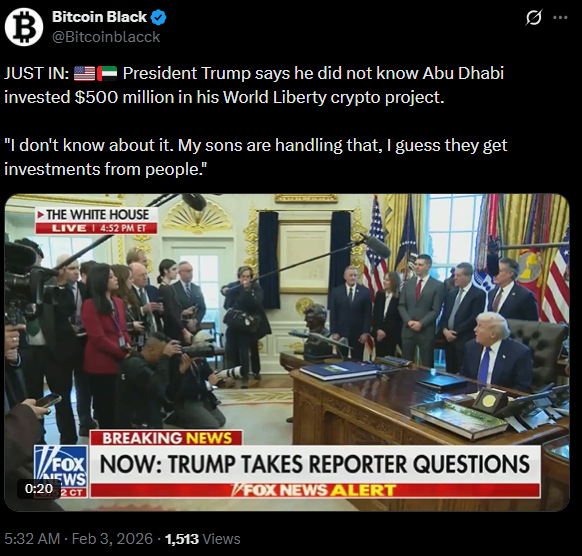

US President Donald Trump has publicly denied any knowledge of a major investment by an Abu Dhabi royal in the World Liberty Financial crypto platform. When asked by reporters about the transaction on Monday, Trump stated,

The denial follows a report by the Wall Street Journal that Sheikh Tahnoon bin Zayed Al Nahyan, a member of the Abu Dhabi royal family, acquired a 49% stake in WLFI for $500 million just four days before Trump was inaugurated as president. According to the WSJ, the details come from WLFI documents and comments from individuals familiar with the matter. The reported first installment of the investment totaled $250 million. Of this, $187 million was directed to entities linked to the Trump family, while $31 million went to an entity associated with WLFI founders Zak Folkman and Chase Herro. This breakdown underscores the scale of the transaction and the financial linkages between the parties, though Trump maintains he was not involved personally.

Implications for WLFI and the Trump family

The timing and size of the Abu Dhabi investment have drawn attention because it represents one of the largest foreign stakes in a US-affiliated crypto platform. By acquiring nearly half of WLFI, Sheikh Tahnoon's company, Aryam Investment 1, would have become the platform's largest shareholder, potentially influencing corporate decisions and governance.

The deal also highlights the growing intersection of crypto ventures with international investors. WLFI, like many emerging blockchain and crypto platforms, relies on large-scale investments to expand operations, fund product development, and establish credibility in a competitive market. The involvement of a prominent foreign investor adds both financial backing and scrutiny from regulators and the media.

While Trump himself denied awareness, the statement indicates that operational management and investment decisions within the family network may be delegated to his children, a point that could become significant if WLFI's corporate or financial disclosures are examined.

Global crypto investment dynamics and political analysis

This case challenges the intersection of political figures, high-value crypto deals, and international investment. Foreign involvement in US-based crypto platforms can raise questions around compliance, regulatory oversight, and transparency, especially when figures with political prominence are linked indirectly to financial transactions.

As WLFI continues to expand and attract institutional capital, the $500 million stake will likely remain a topic of discussion. It also reinforces the trend of high-net-worth international investors entering the US crypto market, particularly in platforms promising rapid growth and large-scale adoption. With cryptocurrencies under increasing regulatory attention worldwide, including scrutiny on foreign investments and transparency requirements, both WLFI and the Trump family's financial network may face heightened media and regulatory oversight.

Conclusion

While the Abu Dhabi investment in WLFI marks a significant move in the crypto space, Trump's clear denial underscores the separation between his personal awareness and the actions of family-managed investment vehicles. Whether this transaction will lead to deeper scrutiny of foreign involvement in US crypto ventures remains to be seen, but it highlights the complexities and international dimensions of modern digital finance.