Summary:

- Ripple launched a corporate treasury platform that blends traditional cash and liquidity management with blockchain settlement rails.

- Built on the company's $1 billion acquisition of GTreasury, the system connects treasury management software with digital asset infrastructure.

- The platform aims to reduce settlement delays, streamline cross-border flows, and enable yield strategies for idle cash.

- Ripple's stablecoin, Ripple USD (RLUSD), plays a role in the network's liquidity and settlement fabric.

- The launch coincides with broader market interest in tokenization and 24/7 settlement outside standard banking hours.

Ripple has taken a notable step beyond its familiar role in payments and remittances with the launch of a corporate treasury platform designed to integrate blockchain settlement directly into financial back offices. The platform marries traditional treasury management tools with digital asset infrastructure, signaling that blockchain is no longer just for niche use cases but may play a central role in how companies manage cash and liquidity.

The new system is built on the software of GTreasury, a treasury management provider Ripple acquired in October for $1 billion. GTreasury's tools have long been used by corporate finance teams to manage cash, forecasts, risk exposures and payments. By layering Ripple's blockchain rails and stablecoin infrastructure on top, the platform aims to give finance professionals a unified view of their finances while harnessing the efficiency potential of distributed ledger technology. According to Ripple's blog post announcing the platform, businesses often struggle with multi-day settlement cycles and limited visibility across accounts. Those challenges can slow decision-making and tie up capital unnecessarily. Ripple said the treasury platform addresses these pain points by using its blockchain and stablecoin rails to shorten settlement times and reduce the friction typically seen in cross-border transfers.

One of the practical advantages Ripple highlights is the ability to support yield strategies for idle cash outside traditional banking hours. Treasury teams frequently hold large cash balances to meet operational needs, but traditional systems offer limited avenues to put those funds to work overnight or over weekends. By integrating digital asset rails, Ripple's platform aims to let treasurers deploy capital toward compliant yield strategies while still respecting existing risk and investment policies. For many corporate finance professionals, the idea of stepping outside the existing banking infrastructure can be daunting. Treasury operations are governed by risk controls, compliance requirements and legacy processes that are not easily reworked. Ripple's offering is designed to augment these systems rather than replace them, letting companies maintain current workflows while gaining the benefits of faster settlement and broader liquidity options.

Ripple USD and the context of tokenization and extended settlement

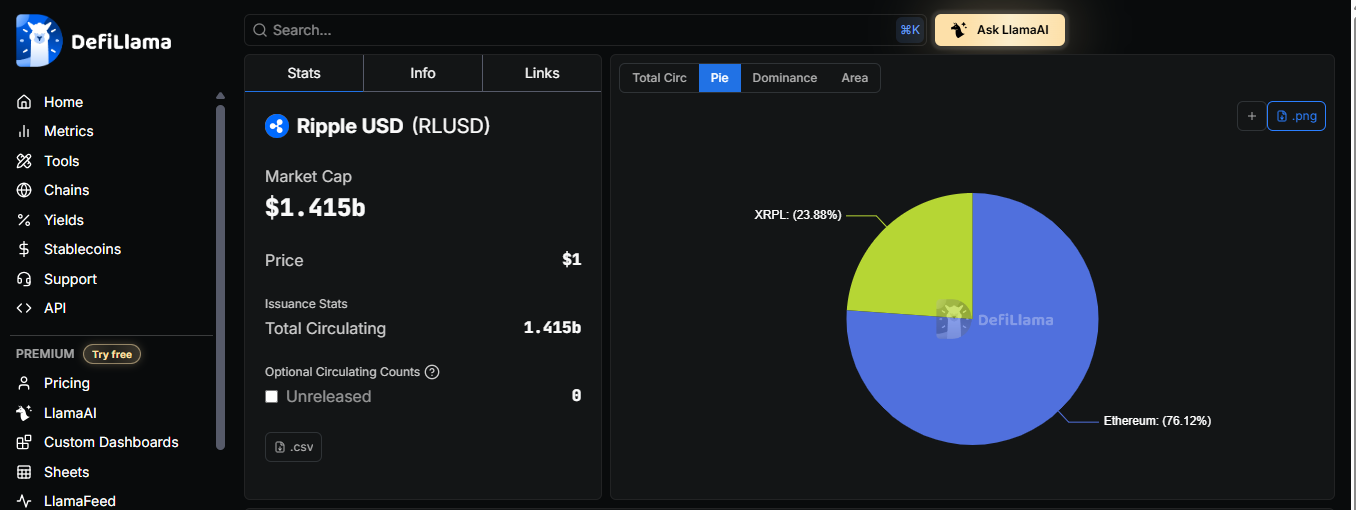

Ripple's push into treasury services reflects broader shifts in how markets are thinking about settlement and liquidity. Traditional financial markets operate within a limited window - typically coinciding with regular banking hours in major time zones. That structure has shaped risk management, capital efficiency and trading patterns for decades. But many industry observers see an opportunity to go beyond those constraints.One major piece of Ripple's infrastructure in this context is Ripple USD (RLUSD), its US dollar-denominated stablecoin. At the time of writing, RLUSD has a market capitalization of around $1.415 billion, according to data from DefiLlama.

Stablecoins like RLUSD are often used as settlement onramps between traditional finance and blockchain networks because they offer a familiar unit of account with near-instant transfer capabilities. The concept of tokenization - converting real-world assets into digital tokens that can be traded and settled on blockchains - is also gaining institutional attention. In December, the U.S. Securities and Exchange Commission issued a no-action letter to a subsidiary of the Depository Trust & Clearing Corporation, allowing it to launch a tokenization service for securities. That move underscores how mainstream market infrastructure is beginning to integrate digital representations of financial assets. Ripple's treasury platform arrives in that evolving landscape. Instead of focusing narrowly on payments, it positions blockchain as a core part of financial operations - from cash management and liquidity to asset allocation and settlement. This reflects a broader market trend where digital assets are gaining a foothold on corporate balance sheets, not just within crypto-native firms but across a range of industries seeking efficiency and transparency.

For companies that have been hesitant to adopt digital rails, the promise of faster settlement, consolidated visibility and compliant yield strategies may prove compelling. Treasury teams often operate with tight risk tolerance and heavy regulatory oversight, so technologies that can enhance existing controls rather than bypass them are more likely to find early institutional adoption.

What this means for corporate finance

Ripple's move into the treasury space highlights how blockchain infrastructure is maturing from speculative use cases into practical tools for large organizations. Traditionally, treasury systems have been built around bank networks, correspondent relationships and batch settlement processes. These systems are reliable but can be slow and opaque, especially across borders. By offering a platform that integrates real-time blockchain settlement with familiar cash-management tools, Ripple is staking a claim in the space where traditional finance meets digital settlement. The platform doesn't just aim to speed up transfers; it seeks to make corporate liquidity more nimble and responsive to global market dynamics. Garlinghouse said

Treasury operations are deeply risk-averse and tightly integrated with existing banking relationships. For many firms, the decision to tie internal accounts to blockchain rails will require careful evaluation of compliance, security, and operational risk. Yet the release of Ripple's treasury platform suggests that the conversation has moved beyond "if" blockchain will play a role in enterprise finance to "how" and "when." As digital assets gain more clarity from regulators and continued innovations in settlement and custody emerge, tools like this one may become part of the regular toolkit for corporate finance leaders.

Built on the foundation of GTreasury's software and Ripple's blockchain infrastructure, the new platform is a bet on a future where digital asset rails and traditional finance can coexist, letting companies manage cash and liquidity with greater speed, transparency, and choice.

READ MORE: COTI Earn Season 3 Explained: Rewards, TPS, Missions, and How It Works