Summary

- The Commodity Futures Trading Commission has expanded its Innovation Advisory Committee to 35 members, adding top crypto executives from Coinbase, Ripple and other leading firms.

- CFTC Chair Mike Selig launched the committee in January to replace the former Technology Advisory Committee.

- Crypto leaders now make up a significant portion of the panel, signaling a more open stance toward digital assets.

- The move comes as the CFTC increases coordination with the Securities and Exchange Commission on crypto oversight.

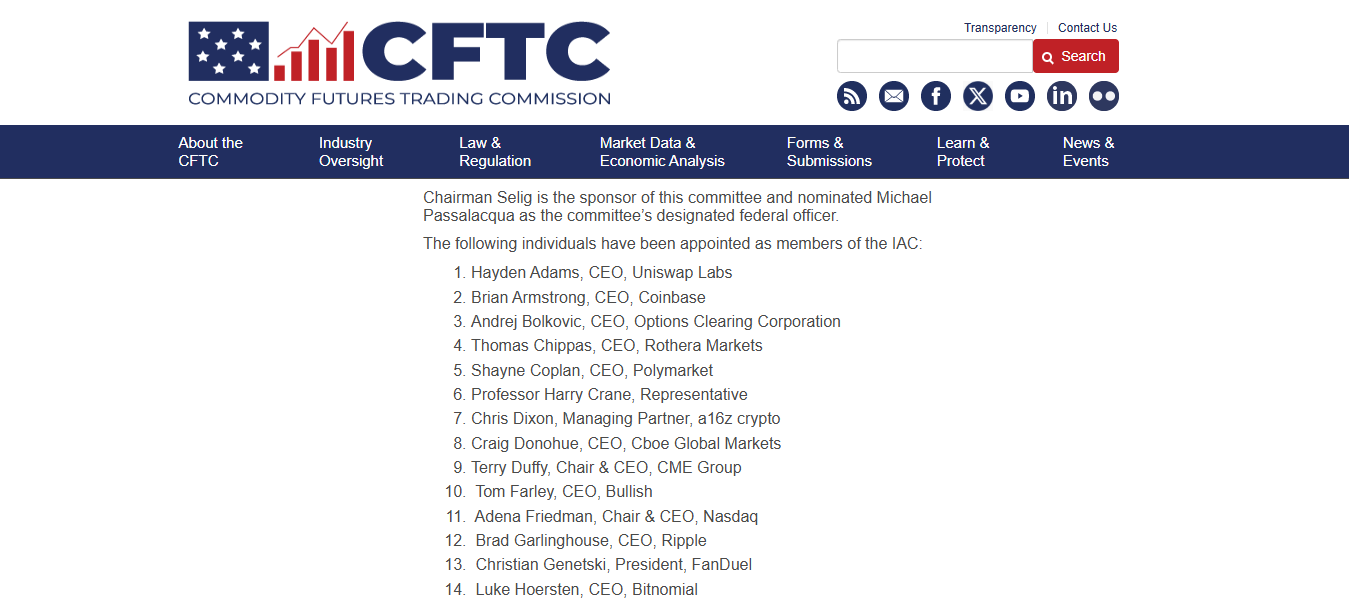

The Commodity Futures Trading Commission(CFTC) has formally added several prominent cryptocurrency executives including leaders from Coinbase and Ripple to its newly established Innovation Advisory Committee (IAC), a move that underscores the regulator's evolving approach to digital assets. The committee, launched in January by Chair Mike Selig, replaces the agency's former Technology Advisory Committee. While the previous panel focused broadly on how emerging technologies affect derivatives markets, the Innovation Advisory Committee is designed to more directly address modern financial innovation including blockchain, crypto markets, tokenization, and prediction platforms. Chairman Selig serves as the sponsor of the committee and nominated Michael Passalacqua as the committee's designated federal officer.

The expansion finalized this week brings the total number of members to 35. In announcing the appointments, Selig emphasized the importance of staying ahead of financial transformation.

The tone of that statement reflects a broader shift and the CFTC appears to be inviting the industry into the policy conversation.

Coinbase, Ripple and Major Crypto Leaders Take a Seat at the Table

Among the newly appointed members are some of the most recognizable figures in the digital asset space. That includes Brian Armstrong, CEO of Coinbase, and Brad Garlinghouse, CEO of Ripple. They are joined by other influential industry voices such as Tyler Winklevoss of Gemini, Shayne Coplan of Polymarket, Kris Marszalek of Crypto.com, and Anatoly Yakovenko of Solana Labs. Traditional financial market leaders are also represented, including executives from Nasdaq, Intercontinental Exchange, Cboe Global Markets and CME Group, creating a cross-section of both crypto-native and legacy finance institutions.

Of the 35 total committee members, 20 are tied to companies directly involved in cryptocurrency. At least five members are connected to prediction markets platforms that allow users to trade on the outcome of real-world events. This composition signals that the CFTC recognizes digital assets and decentralized markets as increasingly intertwined with broader derivatives and commodities markets. The presence of such a large number of crypto executives is notable. For years, industry participants have argued that regulators often crafted rules without sufficient input from those building the technology. This committee structure may offer a more collaborative path forward.

The CFTC appears to be seeking structured dialogue with the companies shaping the sector.

A Broader Regulatory Shift in Crypto Oversight

The committee's expansion comes at a moment when regulatory coordination is becoming more central to U.S. crypto policy. Chairman Selig has signaled that the CFTC will take a more receptive stance toward digital assets and has begun working alongside the Securities and Exchange Commission to coordinate regulatory frameworks. For years, questions about jurisdiction between the CFTC and SEC have created uncertainty for crypto firms. While the CFTC traditionally oversees commodities and derivatives markets, the SEC regulates securities. Many digital assets exist in a gray area between the two categories.

By bringing crypto executives directly into advisory discussions, the CFTC may be positioning itself as a core partner in shaping future oversight - particularly around derivatives tied to digital assets, tokenized commodities, and emerging market structures. The replacement of the Technology Advisory Committee with the Innovation Advisory Committee also reflects the future. This matters because crypto markets have matured significantly. Exchanges, custody providers, token issuers and derivatives platforms now handle billions in daily volume. Prediction markets and decentralized finance applications have expanded into areas that overlap with traditional commodities and futures regulation.

Having industry leaders from firms like Coinbase, Ripple and Solana Labs advising the regulator could help bridge gaps between policy goals and technical realities. At the same time, the move does not signal deregulation. The CFTC's mandate remains market integrity, transparency and investor protection. The advisory committee does not set policy but provides guidance. Final rulemaking authority stays with the Commission. By appointing figures such as Armstrong and Garlinghouse - both of whom have been vocal in regulatory debates - the CFTC sends a message that crypto firms will have a seat at the table as rules evolve.

What's Next

As Selig's statement suggests, the aim is modernization without sacrificing oversight. What is clear is that crypto executives are no longer operating on the sidelines of regulatory conversations. With the Innovation Advisory Committee now fully formed at 35 members, the CFTC has made a visible commitment to engaging with the industry at a structural level.