TL;DR

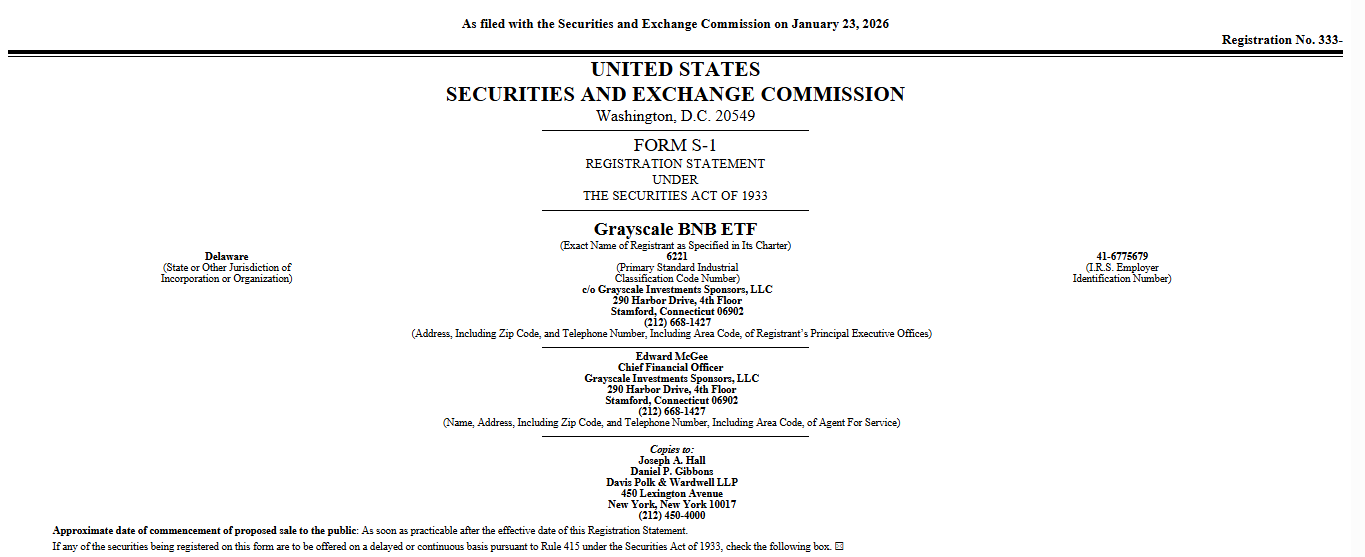

- Grayscale has filed a registration statement with the SEC for a BNB-based exchange-traded fund called the Grayscale BNB ETF.

- If approved, the fund would trade under the ticker GBNB on Nasdaq.

- The ETF would track BNB, the native token of the BNB Chain, closely tied to Binance’s blockchain ecosystem.

- The move places Grayscale alongside VanEck in the growing race to launch BNB-focused investment products.

- The filing reflects a broader shift toward multi-asset crypto ETFs in the U.S. market.

On Friday, the digital asset investment firm filed a registration statement with the U.S. Securities and Exchange Commission for a new product called the Grayscale BNB ETF, marking its entry into the race to bring BNB exposure to U.S. public markets. According to the filing, the proposed fund would track Binance-linked token BNB and would trade under the ticker symbol GBNB if approved. The ETF would be listed on the Nasdaq Stock Market LLC, with Bank of New York Mellon named as transfer agent and Coinbase Custody Trust Company, LLC set to serve as custodian.

The filing describes the fund as holding BNB, which are digital assets based on an open source cryptographic protocol existing on the BNB Smart Chain, comprising units that constitute the assets underlying the Trust’s Shares. In practical terms, that means direct exposure to BNB through a regulated investment vehicle rather than self-custody or exchange trading.

BNB is the native token of the BNB Chain, a blockchain network closely associated with Binance, one of the world’s largest cryptocurrency exchanges. By market capitalization, BNB currently ranks as the fourth-largest cryptocurrency, with a valuation of roughly $122 billion, according to CoinMarketCap. For Grayscale, the move is part of a broader push to extend beyond Bitcoin and Ethereum products and into what the firm sees as structurally important blockchain ecosystems. BNB’s role in powering smart contracts, DeFi activity, and onchain applications across the BNB Chain makes it one of the most widely used utility tokens in the market.

From Bitcoin to multi-asset crypto ETFs

Grayscale’s BNB filing reflects how quickly the crypto ETF landscape is changing in the U.S. market. After years of regulatory resistance, the past year has seen a rapid expansion in crypto-linked exchange-traded products, driven by a more permissive regulatory climate and growing institutional demand.

Funds tracking assets such as Solana, XRP, Dogecoin, Hedera, and Chainlink have already launched. Bitcoin and Ethereum ETFs, once viewed as regulatory long shots, are now established market instruments. In that context, a BNB ETF no longer feels like an outlier, it feels like a natural next step in a broader diversification trend. Grayscale is not alone in targeting BNB. The firm becomes the second major player to pursue a BNB ETF following VanEck, which filed its own proposal in May 2025. That earlier filing opened the door for BNB to be treated as a mainstream ETF asset class rather than a niche exchange token.

For Grayscale specifically, the BNB move builds on an already aggressive expansion strategy. The firm has listed ETFs tied to Bitcoin, Ethereum, Chainlink, Dogecoin, and XRP, and is also in the process of converting its existing Near-linked closed-end trust into an ETF structure. The pattern is clear: Grayscale is positioning itself as a multi-chain, multi-asset gateway for regulated crypto exposure. This approach reflects a shift in how crypto investment products are being structured. Early ETFs focused on “store of value” narratives and simple exposure models. Newer filings target full ecosystems, networks with developer activity, infrastructure use cases, and onchain economies rather than just price speculation.

BNB fits that model well. It functions as gas for transactions, governance participation, application deployment, and ecosystem services across the BNB Chain. That makes it more comparable to Ethereum than to a meme asset or pure trading token.

What GBNB signals for the ETF market

If approved, GBNB would give traditional investors a regulated way to gain exposure to BNB without holding the token directly. That matters for institutions restricted by custody rules, compliance frameworks, and internal risk policies that prevent them from interacting with crypto wallets or exchanges.

But the filing also carries broader implications. It signals that crypto ETFs are moving away from being experimental financial products and toward becoming standard portfolio instruments. The growing list of token-specific ETFs suggests the market is normalizing crypto exposure across multiple networks rather than treating Bitcoin and Ethereum as exceptions. It also reflects how competitive the ETF landscape has become. The race now is about who can offer the widest exposure to the crypto economy in regulated form.

For BNB specifically, an ETF could reshape how the asset is perceived in traditional markets. Instead of being framed primarily as a Binance-linked token, it becomes framed as a blockchain infrastructure asset, one tied to smart contracts, DeFi platforms, and decentralized applications. Regulatory approval is far from guaranteed, and the SEC review process remains complex. But the filing itself shows how far the market has shifted. A few years ago, a BNB ETF filing would have been unthinkable. Today, it’s part of a growing wave of crypto-native financial products moving into traditional market structures. Crypto assets are increasingly being treated as part of the financial system’s core infrastructure, not its edges.

READ MORE: COTI Earn Season 3 Explained: Rewards, TPS, Missions, and How It Works