Summary:

- Senators Elizabeth Warren and Andy Kim have asked Treasury Secretary Scott Bessent to review a reported $500 million UAE-backed investment in World Liberty Financial (WLFI).

- The lawmakers want the Committee on Foreign Investment in the United States (CFIUS) to determine whether the deal poses national security or data privacy risks.

- The investment would reportedly give a UAE-backed fund a 49% stake in WLFI and make it the firm's largest known outside shareholder.

- The senators cited concerns about foreign influence, access to Americans' financial data and previous allegations tied to WLFI token sales.

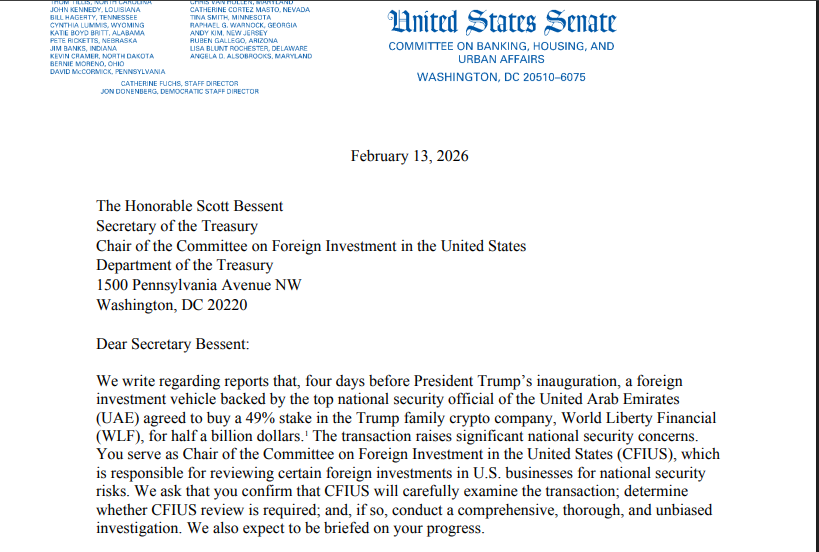

Two senior U.S. lawmakers urged the Treasury Department to examine a reported foreign investment in a cryptocurrency venture linked to the Trump family, arguing that the deal could raise serious national security and data privacy concerns. In a Friday letter to Treasury Secretary Scott Bessent, Massachusetts Senator Elizabeth Warren and New Jersey Senator Andy Kim called on the government to determine whether the Committee on Foreign Investment in the United States (CFIUS) should investigate a transaction involving World Liberty Financial.

According to the letter, a United Arab Emirates-backed investment reportedly agreed to purchase a 49% stake in WLFI for roughly $500 million. The lawmakers noted that the transaction allegedly took place just days before the inauguration of Donald Trump and would make the foreign fund the company's largest shareholder and only publicly known outside investor. Warren and Kim asked Bessent, who chairs CFIUS, to confirm whether the committee was formally notified of the deal. If not, they urged the Treasury to ensure a "comprehensive, thorough, and unbiased investigation." CFIUS is responsible for reviewing certain foreign investments in U.S. businesses to assess potential national security risks. Its mandate includes examining whether foreign entities could gain access to sensitive technologies, infrastructure, or personal data belonging to U.S. citizens.

In their letter, the senators expressed concern that the structure of the reported transaction could allow a foreign government to exert influence over a U.S.-based crypto company that handles financial and personal information.

Source:

Concerns Over Foreign Influence and Sensitive Data Access

The reported investment was allegedly backed by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE's national security adviser. The lawmakers wrote that the agreement directed approximately $187 million to entities linked to the Trump family and granted two board seats to executives connected to G42, a technology firm that has previously drawn scrutiny from U.S. intelligence agencies over concerns about ties to China.

The senators argued that such an arrangement could provide a foreign government with meaningful leverage inside a company operating in the financial technology sector. They pointed to WLFI's privacy disclosures, which indicate that the firm collects information including wallet addresses, IP addresses, device identifiers, and approximate location data. The company may also obtain certain identity-related records through service providers. While this type of data collection is common in digital finance platforms, Warren and Kim stressed that when a foreign-backed entity gains a significant ownership stake, the stakes change. CFIUS typically evaluates whether a foreign investment could result in access to "sensitive personal data" of U.S. citizens.

In recent years, the committee has increasingly focused on technology and financial platforms, especially those handling large amounts of user information. The lawmakers requested a response from the Treasury Department by March 5, asking for clarity on whether the transaction was reviewed or whether additional action is planned. Last year, Senator Warren and Senator Jack Reed sent a letter to the Justice Department and Treasury Department urging authorities to investigate alleged links between WLFI's token sales and sanctioned foreign actors. In that November letter, they cited claims that WLFI governance tokens were purchased by blockchain addresses tied to North Korea's Lazarus Group, as well as Russian and Iranian-linked entities. Although no formal findings have been publicly announced in connection with those earlier allegations.

Trump Responds: "My sons are handling that"

The controversy has also drawn public comment from Donald Trump himself. Earlier this month, Trump said he was unaware of the reported multimillion-dollar investment linked to an Abu Dhabi royal and entities connected to WLFI. He stated that he had no direct involvement in the transaction.

Trump said, distancing himself from operational decisions tied to the crypto platform. The reported timeline of the investment occurring just days before the January 20 inauguration has added another layer of political concern. Lawmakers argue that even the appearance of foreign influence tied to a venture associated with a sitting president's family warrants close examination. For its part, CFIUS operates independently of political campaigns and focuses strictly on national security implications. However, the committee's reviews can carry significant consequences, including recommendations to block or unwind transactions deemed risky. The broader issue raised by the senators touches on a growing trend that foreign capital is flowing into the United States based crypto and fintech firms.

As digital asset platforms handle increasing volumes of financial transactions and store more user data, they are becoming strategically significant. Supporters of open investment argue that global capital strengthens U.S. innovation and competitiveness. Critics counter that certain sectors, particularly those managing sensitive financial or personal data require heightened safeguards.

Closing Thoughts

The Treasury Department has not yet publicly responded to the senators' letter. Whether CFIUS ultimately launches a formal investigation may depend on details not yet disclosed publicly, including the structure of the investment vehicle and the extent of governance rights granted. But the clear thing is that the intersection of crypto, foreign investment, and national security is becoming an increasingly complex area of policy. As lawmakers continue to scrutinize high-profile transactions, firms operating in the digital asset space may find themselves navigating geopolitical sensitivity.

READ MORE: Vitalik Said "Build Something New." COTI Already Did