Summary:

- European Central Bank preparing for a 12-month digital euro pilot in 2027

- Payment Service Provider (PSP) selection expected to begin in Q1 2026

- Pilot will involve real-world transactions in a controlled Eurosystem setup.

- Pilot aims to strengthen banks' role amid rising private payment solutions and planning Moves Into the Next Phase

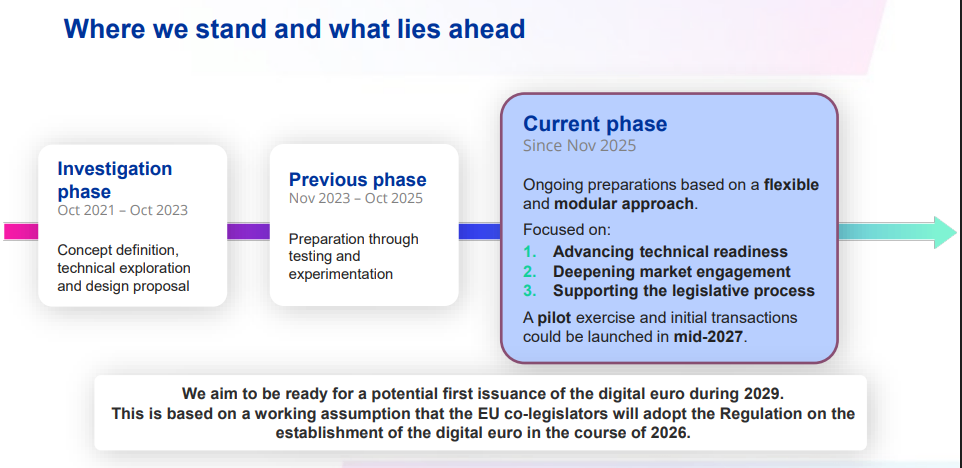

Europe's plans for a central bank digital currency are starting to move from concept into practical work. The European Central Bank is now preparing to select licensed Payment Service Providers (PSPs) that will take part in its upcoming digital euro pilot, expected to begin in the second half of 2027.

Speaking during an executive committee meeting of the Italian Banking Association earlier this week, ECB Executive Board Member Piero Cipollone outlined the next stage of preparation. According to Cipollone, PSP selection is set to begin in the first quarter of 2026, marking one of the first tangible steps toward testing the digital euro in real-world environments. He stated:

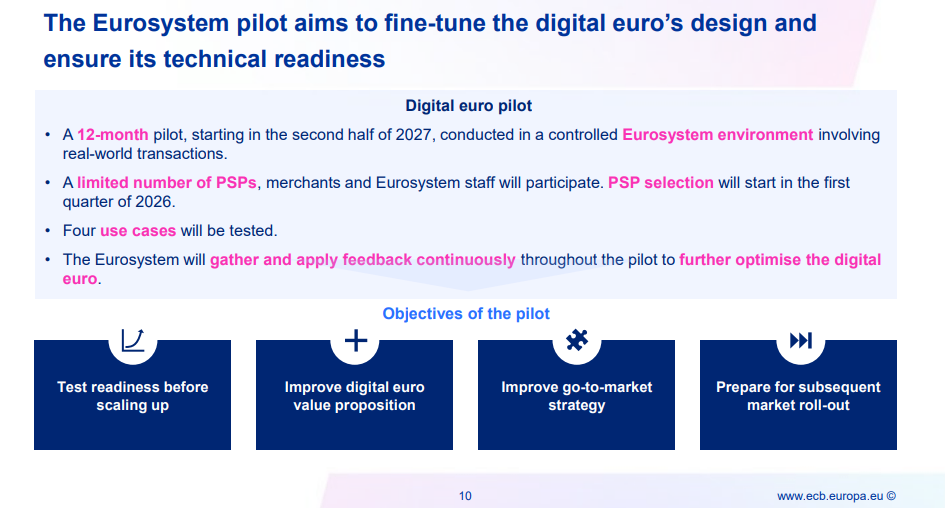

That timeline depends heavily on legislative approval from European Union policymakers, who are currently reviewing the legal framework needed to support a central bank-issued digital currency across member states. Once the pilot begins, it will run for 12 months in what ECB officials describe as a controlled Eurosystem environment. The test phase is expected to include actual payment scenarios involving a limited number of PSPs, merchants and Eurosystem staff.

Real-World Testing and Bank Participation

The ECB's upcoming pilot will move beyond theory and into actual payment scenarios. Instead of lab-style simulations, the test phase is expected to involve real transactions carried out by a small group of selected PSPs, merchants, and Eurosystem staff within a controlled setup. As outlined by European Central Bank, the program will run for 12 months starting in the second half of 2027, during which a handful of everyday payment use cases will be trialed. Feedback collected throughout this period will be used to adjust how the digital euro functions before any wider rollout is considered.

For participating providers, this offers an early chance to work directly with core processes like onboarding users, settling payments, and managing liquidity inside a central bank-backed framework. However, beyond testing infrastructure, the digital euro is also being framed as a way to support Europe’s domestic financial institutions in an increasingly digital payments landscape.

Responding to Private Payment Competition

Cipollone made it clear that stablecoins are not the only challenge banks are facing. Addressing Italy's banking association, he argued that the broader shift toward digital payments has already begun reducing the role of physical cash - currently the only form of central bank money available to the public. The digital euro, in this sense, is being positioned as a crypto-based payment system and also to privately developed platforms and payment apps. Addressing the risk of banks gradually losing relevance in the payments ecosystem, Cipollone said the initiative would help the central position of banks in payments. He added:

The ECB also sees the pilot as a way to protect existing domestic payment networks across the region, including Italy's Bancomat card system and Spain's Bizum peer-to-peer payment platform, from being sidelined by international or privately issued alternatives.

Final Thoughts

The digital euro is slowly moving in the ground work with provider selection expected to begin this year and a live pilot planned for 2027. For banks and payment firms across Europe, this pilot is more about staying relevant in a payments space that’s already shifting toward private digital solutions. As noted by Piero Cipollone, the goal is to make sure traditional institutions remain part of how money moves in an increasingly digital economy.

Whether the broader rollout arrives by 2029 or later, the next phase will likely shape how central bank money fits into modern payment networks without pushing banks to the sidelines.

READ MORE: Vitalik Said "Build Something New." COTI Already Did