Summary:

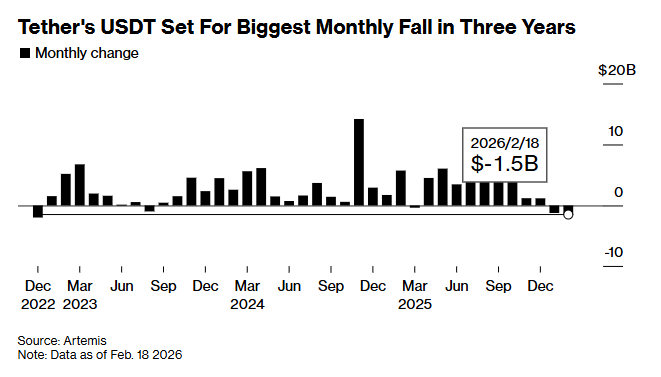

- Tether's USDT supply has dropped by around $1.5 billion in February so far

- January already saw a $1.2 billion reduction in circulating supply

- This puts USDT on track for its largest monthly decline since November 2022

- Large holders appear to be redeeming or reallocating capital

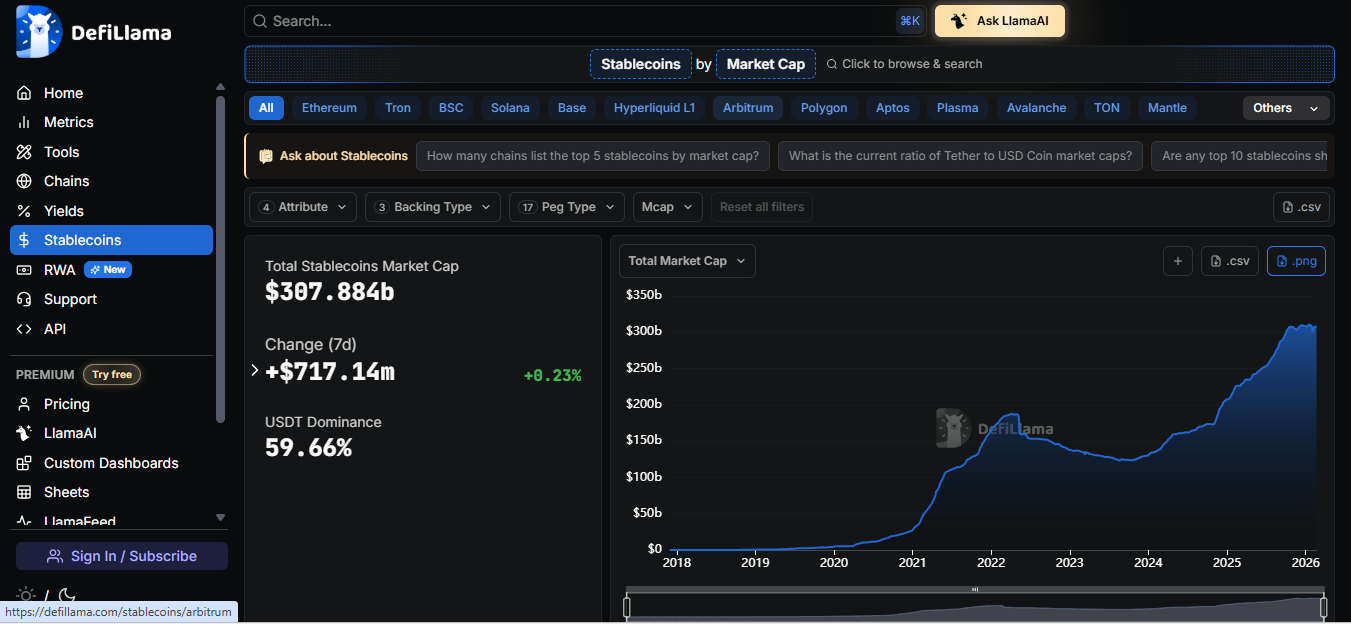

- The broader stablecoin market cap has still grown to $307 billion

Tether's USDT, the largest US dollar-pegged stablecoin by circulation, is now on course to record its steepest monthly supply drop in nearly three years. Blockchain data suggests that large holders have been steadily redeeming tokens throughout February, pushing the circulating supply lower for the second consecutive month. So far this month, USDT's circulating supply has declined by roughly $1.5 billion. That follows a separate $1.2 billion reduction recorded in January. Taken together, the pace of redemptions points toward the biggest monthly contraction since the fallout from the collapse of FTX in November 2022.

Back then, USDT supply fell by around $2 billion in December 2022 as market participants rushed to adjust exposure after one of the most significant breakdowns in the industry's history. The exchange's failure, along with over 150 related entities, triggered widespread caution across trading desks and liquidity providers. However, USDT continues to serve as the main entry point for crypto investors moving capital into digital asset markets. Any sustained decrease in its supply can point to tightening liquidity, especially during periods of uncertain sentiment.

At present, USDT's market capitalization stands at around $183 billion. That figure represents close to 71% of the total stablecoin sector, based on data from CoinMarketCap.

Stablecoin Activity Still Climbs Despite USDT Pullback

Interestingly, the retreat in USDT has not spilled over into the broader dollar-linked stablecoin market. Data from DeFiLlama shows that the total combined market capitalization of stablecoins has actually increased by about 2.33% so far in February. The figure has moved from roughly $300 billion at the start of the month to around $307 billion. That suggests the current trend may be repositioning within the stablecoin segment itself.

Recent policy backing in the United States has helped accelerate interest in digital dollar-based assets among both technology companies and financial institutions. Earlier this year, World Liberty Financial Inc. - a crypto venture linked to the Trump family - introduced its own stablecoin, USD1. Transaction activity across the stablecoin market has also climbed sharply. In 2025, total volumes rose by 72% to reach $33 trillion. USD Coin led usage with $18.3 trillion worth of transfers during the year, while Tether's USDT followed with $13.3 trillion in transaction volume.

At the same time, USD1 has recorded rapid growth. Its market capitalization expanded by roughly 50% over the past month and was valued at about $5.1 billion as of Friday, according to DeFiLlama.

Market Split Between Whales and New Entrants

The latest supply movements appear to reflect a divide in two sides. On one side, large holders - often referred to as whales have been reducing their USDT balances. Some of this capital may be moving into alternative stablecoins, while a portion could also be returning to traditional financial markets. On the other hand, new participants continue to enter the space, absorbing available liquidity and maintaining overall issuance levels across the sector.

This push and pull helps explain why USDT supply is shrinking even as the total stablecoin market remains broadly stable. It points toward redistribution with capital shifting between issuers. If the trend continues into March, it could offer an early signal about broader positioning ahead of the next phase of crypto market activity.

READ MORE: Vitalik Said "Build Something New." COTI Already Did